Why Selling Options Beats Buying: A Look at Covered Calls and Cash-Secured Puts

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 76%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Overview

Options trading can be approached from many angles, but two of the most widely used and effective strategies for generating consistent income are the covered call and the cash-secured put. Both are grounded in a simple yet powerful concept: rather than speculating by buying options, you become the seller and collect premium up front. This shift in perspective takes advantage of the natural characteristics of options pricing, creating a higher probability of profit compared to option buyers.

The Covered Call Setup

A covered call involves owning 100 shares of a stock (the “cover”) and then selling a call option against those shares. The call obligates you to sell the stock at the strike price if exercised, but in exchange you collect the option premium. This strategy works best in sideways or moderately bullish markets, where the stock doesn’t surge far beyond the strike price. Your profit comes from two sources: (1) any capital gains up to the strike price and (2) the call premium collected. The trade-off is that your upside is capped at the strike, but you benefit from steady income generation and partial downside cushion thanks to the premium.

The Cash-Secured Put Setup

A cash-secured put is the mirror image of the covered call. Here, you commit cash equal to 100 shares of stock at the strike price and sell a put option. If the stock stays above the strike, the option expires worthless, and you keep the premium. If the stock falls below the strike, you are obligated to buy the shares at the strike price, effectively entering the position at a discount thanks to the premium you received. This strategy is ideal for investors who don’t mind owning the stock at a lower entry price and prefer to be paid while waiting for the opportunity.

Set-up Example

Why Selling Premium Has the Edge

Both strategies exploit the fact that options decay in value over time (theta decay) and that implied volatility often overstates realized volatility. In other words, option prices usually build in a margin of “extra fear” that favors the seller. Buyers must not only predict direction correctly but also overcome time decay and volatility mispricing. Sellers, on the other hand, benefit from multiple paths to profit: the stock can move in their favor, stay flat, or even move modestly against them and they still come out ahead, so long as it remains within the range covered by the premium collected.

The Profit Expectation Gap

Academic studies and market statistics consistently show that a majority of options expire worthless or are closed at a loss by the buyer. This doesn’t mean buying options can’t be lucrative—it offers asymmetric upside in the right scenarios—but it highlights why selling premium has a built-in probability advantage. Covered calls and cash-secured puts use this advantage in a disciplined, risk-defined way: you own the stock or secure the cash, ensuring you can fulfill your obligation while collecting steady income.

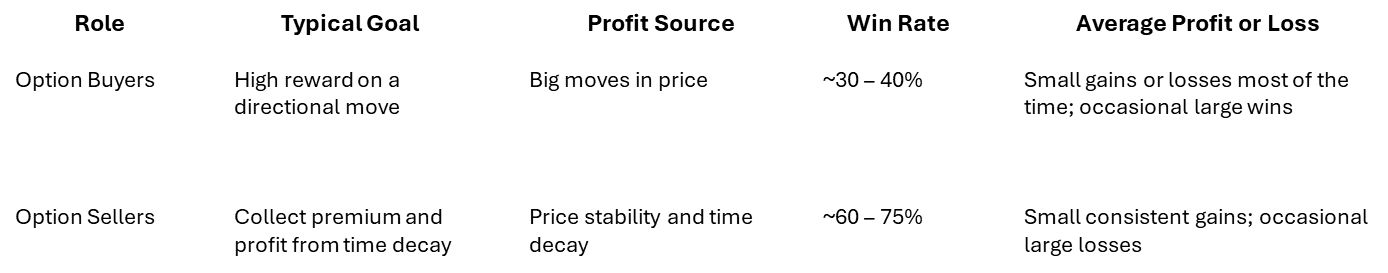

Profit and Loss Expectations

1.Winning Percentage

•Option sellers, particularly those selling out-of-the-money options, win about 60–75% of trades because:

•Options are priced with a time premium.

•Most option expire worthless (~70-80% never get exercised).

•Option buyers achieve profitable outcomes less frequently, typically within a 30-40% success rate; however, successful trades can yield substantial returns.

2.Profit and Loss Distribution

•Sellers have a positive expected value per trade but are exposed to large losses during negative market events.

•Buyers lose small amounts frequently but can occasionally have very large wins.

Summary

Conclusion

For investors seeking consistent results and a systematic framework, covered calls and cash-secured puts offer a practical alternative to speculative option buying. By selling premium, you align with the probabilities, collect steady income, and manage risk with clear obligations. Over time, these strategies not only generate higher profit expectations but also build discipline, consistency, and portfolio resilience—hallmarks of successful investing.

More Information

For a short video explaining the Bull Strangle strategy.

For a more detail on the strategy

For performance summary of last weeks trades

To subscribe to the Bull Strangle Newsletter

Contact

Darren Carlat

Managing Director

(214) 636-3133

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.